Impact investing has actually backed itself into a corner because it’s hard to test whether a modification in an indication can be dependably credited to an investment or business. Impact investing has actually backed itself into a corner since it’s challenging to evaluate whether a change in a sign can be reliably associated to an investment or business.

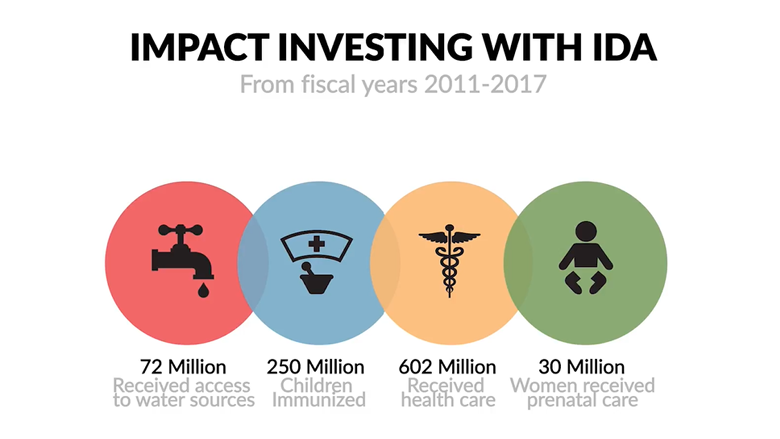

Often, impact investors end up counting on bad science. They count the variety of hours children spent exercising, the number of meals provided, or other metric that is too typically loosely based on a complex theory of modification without any credible way to confirm connections in between effects and a business’s actions, items, or invoice of a specific investment.

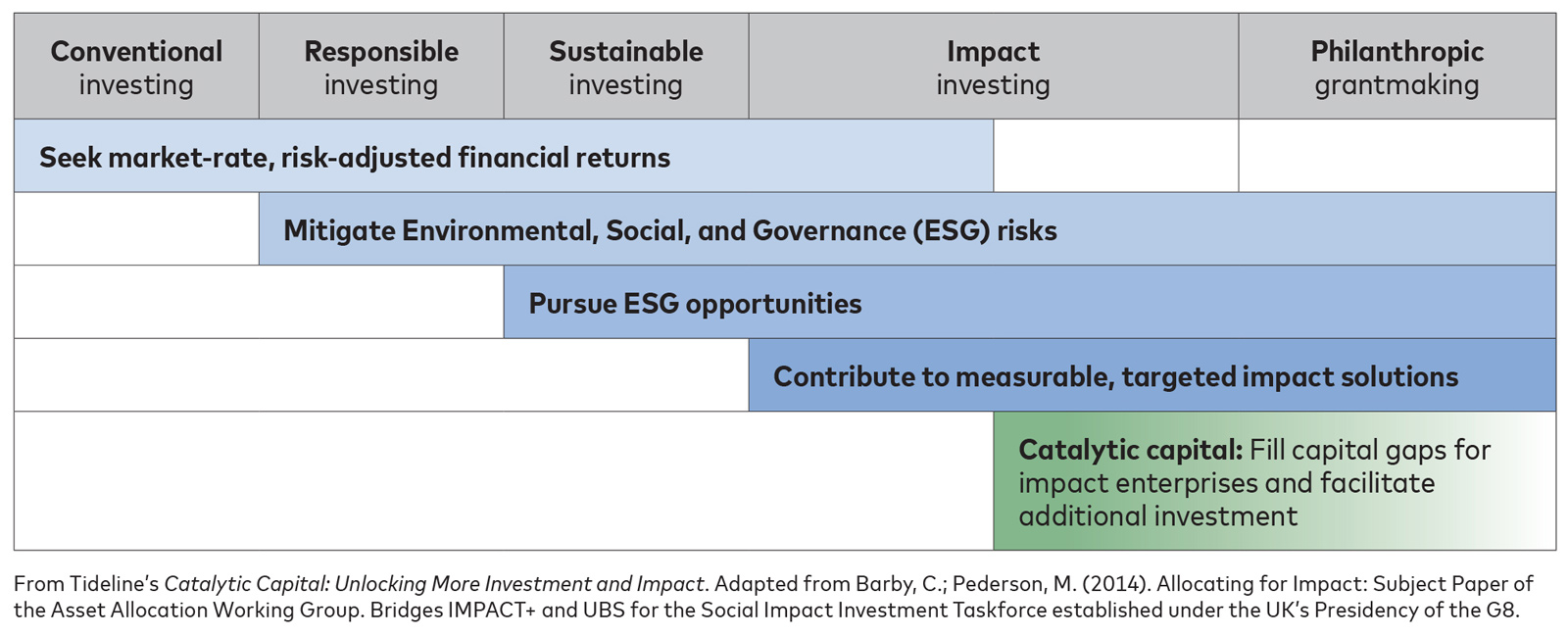

The focus also needs to move to a regime of corporate disclosures connected to a business’s audited monetary accounts. These disclosures would be stemmed from the intrinsic, core operations of a firm using the metrics of standard investing. They depend on macroeconomic presumptions about how markets work and how they can be made to work much better to take full advantage of long-term, inclusive, sustainable wealth development, instead of short-term earnings.

This does not imply an impact investor need to never rigorously test for a set of guaranteed advantages. It’s proper to do so if a service claims an item will fix a particular problem. However lots of, if not most, businesses do not produce services or products that directly or materially impact the poor or reverse worldwide warming.

For the most part, impact investors should material themselves with disclosures that offer information on the following:. When a business sells a product, a few of the earnings flows to employees, senior managers, suppliers, professionals, financial institutions, and, through taxes, federal governments. Is wealth being shifted to shareholders at the cost of contractors, direct staff members, or a provider’s labor force? Simply put, what are the go back to labor in addition to go back to capital? Reducing inequality of earnings within and throughout nations is at the heart of impact investing. Tysdal business broker denver.

Opportunities Fund Private

Examples of risk-increasing threats include the depletion of reserve stocks of forests or fisheries, bribery of political leaders and regulators, and underrepresentation of females and minorities. For example, a logistics business targeting metropolitan customers accidentally advantages rural neighborhoods because general market fragmentation is decreased. A surplus is developed when the price paid is less than the optimum rate that the customer may be ready to pay.

Transparently divulging product rates and market share details is further evidence. Impact investors might not enjoy to opt for what are mostly accounting and appraisal exercises – wife invested. However, these approaches will get more traction than non-verifiable, non-credible claims that a particular advantage is attributable to a company or a financial investment.

Nevertheless, they completely appreciate the many challenges to investing in underperforming sectors in low-income countries: it’s difficult to satisfy requisite payback periods or break-even standards; the needed investments are big and inevitably have high deal expenses due to their complexity; and there is the reputational threat of operating in bad countries with fragile government organizations and unforeseeable regulatory programs.

It requires arable land, substantial roadways, irrigation, high-quality inputs tailored to several microclimates, mechanization, transport, networks of proficient smallholder farmers, some larger farms, food processors, reliable low-priced power, access to markets, food sanitation and security requirements, trade guideline, various types of funding, insurance coverage, and good weather condition. These components need to come together to beneficially provide harvests to consumers.

They have the production capability and abilities to manage the scope and scale of these investments profitably (Tysdal conspiracy commit securities). They are well-placed to obtain and scale new innovations along with the innovative service designs vital for success in low-income nations (LICs) and low- and middle-income countries (LIMCs). They have the reach, through trade and worldwide supply and worth chains, to deal with problems of market gain access to and inconsistent regulatory execution.

Carter Agreed Pay

They have exceptional access to short- and long-term financing at the most affordable offered rates, in addition to internally produced capital. Larger local and global business, not small ventures, can deal with such complex endeavors. Finally, for all their danger hostility and attention to short-term quarterly earnings, large and local corporations may best value that underlying long-lasting trends prefer greater returns in emerging and frontier markets over the coming decades. Usually, interest paid on that additional debt concerned about $81 over 5 years. Presuming that 1.3 million trainees finished the EverFi program over 5 years and they all saved $81, the economic worth of the program would amount to $105 million. We approximated that the social impact of the three EverFi programs combined had a five-year financial worth of about $931 million: $194 million for Investors Said, $632 million for Sanctuary, and $105 million for monetary literacy.

Therefore we adjust the social worths stemmed from applying the anchor study to show the quality and relevance of the research. We do this by calculating an “impact awareness” index. We designate worths to 6 risk categories and total them to get here at an impact-probability score on a 100-point scale.

Together these represent 60 of the possible 100 points. Anchor research studies based upon a meta-analysis or a randomized regulated trial benefit leading ratings, whereas observational research studies rate lower. Investors Said’s research study remained in the former classification; Sanctuary’s and the monetary literacy program’s studies remained in the latter. Establishing the linkage between an anchor research study and the preferred outcome of a services or product sometimes requires making presumptions, and with more assumptions comes higher risk.

In applying the index to EverFi’s programs, Increase determined impact-probability ratings for InvestorsEDU Said, Haven, and the financial literacy program at 85%, 55%, and 75%, respectively. Then it adjusted their approximated monetary impact accordingly, reaching $164 million for InvestorsEDU Said, $348 million for Sanctuary, and $77 million for the financial literacy program.

Securities Fraud Theft

Investors can utilize social science reports to estimate a company’s impact potential. Building the index showed challenging. We fine-tuned the danger classifications and the worths assigned to each often times on the basis of feedback from experts in evaluation and measurement. For instance, one version emphasized the importance of comparing study results according to geographysay, country or continent.

The impact-realization index attempts to catch the most important aspects of threat, however we recognize that it does not record every danger to impact or all the nuances of danger between anchor studies and a company’s item or service. We anticipate to make improvements as others bring new concepts to the table.

It is, however, a new concept in social investment, where attention typically concentrates on measuring present or historical impact – Tysdal titlecard capital group. To be sure, for numerous tasks (giving chlorination tablets, for example) the social impact (safer water) does shortly outlast the program. But others (such as setting up solar panels) can have a longer-term impact (the panels save energy long after they’re installed).

Here’s how Increase addresses this question: Beginning with the estimated value of impact in the last year of financial investment, Rise examines the probability that both output (people reached) and social value will continue undiminished for 5 more years – partner grant carter. Companies with high likelihoods on both counts get a discount rate of 5%, suggesting that annual residual value falls by 5%.

To estimate the terminal value of EverFi’s programs for a post-ownership duration from 2022 to 2026, Increase assumed that their estimated $159 million in total impact for 2021the last year of its investmentwould likewise be created in each of the following five years. That figure was then marked down by 20% per annum intensified, reflecting presumptions about the number of users finishing from the programs and the likely period of the training’s impact.

Opportunities Fund Private

Rise included that amount to the risk-adjusted $589 million in impact understood during the financial investment holding period to get a total impact of about $1.1 billion. The final step in calculating an IMM differs for businesses and investors. Services can just take the approximated worth of a social or environmental advantage and divide it by the total financial investment.

The business would simply divide $200 million by $25 million. Hence the eyewear creates $8 in social value for each $1 invested. The IMM expresses this as 8X. Investors, nevertheless, must take an extra step to represent their partial ownership of business they are bought. Expect Rise invests $25 million to purchase a 30% ownership stake in a business projected to generate $500 million in social value.

And make all the steps in your computation transparent. When others comprehend your assumptions, they can assist you improve them to generate more-robust numbers. We likewise suggest utilizing sensitivity analysis to show what happens to an IMM if you alter the underlying assumptions. This procedure will assist you identify the key chauffeurs of social value.

Debt Investors Cobalt